Trevor Halstead

Product Manager/Leader & Digital Marketer

Status: Exploring new opportunities

What I'm Working On: I'm currently operating as a fractional product leader for a small field service management software; freelancing Local SEO work for home service businesses.

8+

Yrs product/marketing experience

#2

Employee at previous startup

$16mil

ARR at previous startup

I have 8 years of experience in Product and Digital Marketing. As Employee #2 at Cybrary, I took on a role similar to a co-founder, working hand-in-hand with the founders to build the business from the 3 of us, to more than 100 employees, 4,000,000 users, $125 million valuation and generating $18 million in recurring revenue (B2C & B2B). Among playing a key role in the building of each key department within the business (sales, customer support, customer success), my primary role was head of product. As Cybrary was originally a 100% free product when I joined, I was charged with ideating, developing and leading the go-to-market of revenue-generating product releases to allow the business to monetize.With ancillary skills in marketing, digital acquisition, web design, and product design, I am a versatile product manager/product leader highly capable to take products and teams from 0 -> 1.

Founded in 2015. I joined as employee #2 and spent 8 years building the world's largest cybersecurity training and career development platform.

Backed by the founder of Tenable (NASDAQ: TENB) and the founding team at Rackspace (NASDAQ: RXT)

Fractional product leader for the SaaS software; fractional ops lead for FieldBin Marketing Services. Helping home service business owners build more efficient, more profitable businesses.

Other Things...

Writings, concepts I've designed, things that are interesting to me, etc.

Disclaimer: I have never worked for Whatnot, the information below is based on my own research and observations of the Whatnot app. All screenshots were pulled from publicly available websites or from personal use of the product. When browsing through job listings, I stumbled on Whatnot and became interested. The following is the product of learning more about the company.

Whatnot

Whatnot is an online marketplace and live streaming platform where users can buy and sell a wide variety of collectibles, including toys, cards, and other rare items, through real-time auctions and live shopping events.

Background

I traveled to Japan earlier this year (2024) and became awestruck by the Kawaii culture. For those that don't know what that is, it is their "cute" culture, a cultural phenomenon that emphasizes aesthetics of cuteness, innocence, and youthfulness.There are popular characters central to their culture; for example, Hello Kitty, generates over $8 billion annually in global retail sales.In Japan, this culture has a broad appeal to both children and adults. You'll often find "salary men" after work in claw machine arcades trying to win action figures or stuffed animals.During the 2021/2022 NFT boom, I followed along as the mass hysteria swept crypto culture and digital collectibles took center stage. The creativity and game mechanics began piquing my interest. Giveaways, surprise rewards, points, levels, and more made an appearance; and frankly, it was fun and made me feel like a kid again.Curious to understand the psychological motivations behind collection, I wanted to learn more.Psychologically, collecting satisfies the desire for control and order by allowing individuals to categorize and organize items, which can be comforting and satisfying. It can serve as a tangible connection to the past, evoking nostalgia and emotional memories, related to significant life events or loved ones. Collecting can provide an outlet for self-expression; one's personality, interests, and values to be captured in a something physical (or digital!). Even biologically, some studies have shown that it can trigger the release of dopamine, giving the collector a sense of joy and satisfaction.I won't dive too deep into the economics of collectibles, as this can be quite a complex (and in the case of digital collectibles, highly divisive); but, of course, where there's money to be made, you can be sure humans will find a way to exploit it.All this to say, collectibles is an interesting niche!

Collectibles Market

I researched the collectibles market and found a report from Market Decipher stating that the collectibles market size was estimated at $458.2 billion in 2022 and is expected to cross $1 trillion by 2033, growing at a CAGR of 6.2% across all collectible products.Let’s take a look at some of what we can conclude based on the last round of Whatnot funding (approximately $40 million in revenue at $3.5 billion valuation)Based on $40 million and a 8% take rate (assuming no other revenue streams), Whatnot would have a GMV of roughly $500 million. The global online auction market was $5 Billion in 2021 (so let’s assume it increased to $6 billion in 2022). We could say Whatnot has an 8.33% of the global online auction market.Is the valuation a bit rich?

Short answer, probably. At the time of fundraising, Whatnot would be valued at 87.5x revenue.What’s the ratio of the online auction market to the overall global collectibles market?

Based on the data I could find, the online auctions market only represents about 1.5% of the global collectibles market. There is something to be said that the collectibles market has a LONG way to go to move online. Of course, the biggest challenge to moving online is trust. Verifying something as authentic is ensuring the brand can remain associated with real goods is critical to bring more goods and collectors to Whatnot.Now you may be thinking what I'm thinking which is, "wow is there really that much stuff out there to collect?".

Well, just think about some of these categories:

1. Art and Antiques

2. Coins and Banknotes

3. Stamps

4. Toys and Games

5. Comic Books and Trading Cards

6. Memorabilia

7. Jewelry and Watches

8. Books and Manuscripts

9. Wine and Spirits

10. Historical Documents and Autographs

11. Vintage Clothing and Accessories

12. Musical Instruments

13. Other Categories (e.g., fossils, collectible cars)Yeah, I'd say I can start to see why the collectibles market is so big.

Whatnot Personas

Whatnot Buyer Personas

Non Buyers

- Demographics: Mostly casual visitors, ages 18-45, equal gender distribution.

- Behavior: Browses the platform occasionally, interested in window shopping or exploring.

- Motivations: Curiosity, browsing for future purchase ideas, enjoys the community aspect.

- Pain Points: May feel overwhelmed by the number of options, lack of immediate need or desire to purchase.

- Engagement: Low engagement with auctions, likely to visit the platform infrequently.

Average Buyers

- Demographics: Ages 25-50, balanced gender distribution, middle-income bracket.

- Behavior: Purchases 1-2 items per month, engages with favorite sellers or specific categories.

- Motivations: Enjoys finding unique items at good prices, has specific interests (e.g., vintage clothing, collectibles).

- Pain Points: Sometimes experiences decision fatigue, may be cautious about spending too much.

- Engagement: Moderate engagement, follows a few sellers, participates in auctions regularly.

High Propensity Buyers

- Demographics: Ages 30-55, balanced gender distribution, higher income bracket.

- Behavior: Purchases 8-12 items per month, very active in auctions, often competes in high-value bids.

- Motivations: Passionate about collecting, enjoys the thrill of auctions, looks for investment opportunities.

- Pain Points: Concerns about authenticity, high competition in popular auctions.

- Engagement: High engagement, follows multiple sellers, often interacts with sellers and other buyers.

Big Collectors

• Demographics: Ages 35-60, balanced gender distribution, high-income bracket.

• Behavior: Purchases 50+ items per year, spends large sums on high-value items, very active in niche categories.

• Motivations: Deep passion for collecting, seeking rare and unique items, sees purchases as investments.

• Pain Points: High expectations for quality and authenticity, potential dissatisfaction with customer service.

• Engagement: Very high engagement, close relationships with sellers, may influence trends within the community.

Whatnot Seller Personas

Casual Sellers

- Demographics: Ages 20-45, balanced gender distribution, varied income levels.

- Behavior: Sells occasionally, possibly clearing out personal collections or selling as a hobby.

- Motivations: Extra income, decluttering, sharing passions with others.

- Pain Points: Inconsistent sales, lack of time to dedicate to regular selling, may struggle with marketing.

- Engagement: Low to moderate engagement, uses the platform sporadically.

Part Time Sellers

- Demographics: Ages 25-50, balanced gender distribution, middle-income bracket.

- Behavior: Sells regularly but not full-time, often focused on specific categories (e.g., handmade crafts, vintage items).

- Motivations: Supplemental income, enjoys the selling process, growing a small business.

- Pain Points: Balancing selling with other commitments, limited resources for marketing and inventory management.

- Engagement: Moderate engagement, interacts with regular buyers, participates in seller community.

Professional Sellers

- Demographics: Ages 30-55, balanced gender distribution, higher income bracket.

- Behavior: Sells full-time, has a significant following, manages a large inventory.

- Motivations: Primary source of income, business growth, building a brand.

- Pain Points: High competition, managing logistics and customer service, maintaining high sales volume.

- Engagement: High engagement, actively promotes auctions, collaborates with other sellers, uses analytics to drive sales.

Part Time Sellers

- Demographics: Ages 35-60, balanced gender distribution, high-income bracket.

- Behavior: Sells high-value, specialized items (e.g., rare collectibles, luxury goods), known for expertise in a particular field.

- Motivations: Passion for their niche, reputation as an expert, connecting with like-minded buyers.

- Pain Points: Sourcing rare items, maintaining authenticity and quality, high expectations from buyers.

- Engagement: Very high engagement, deeply involved in the community, often educates and advises buyers.

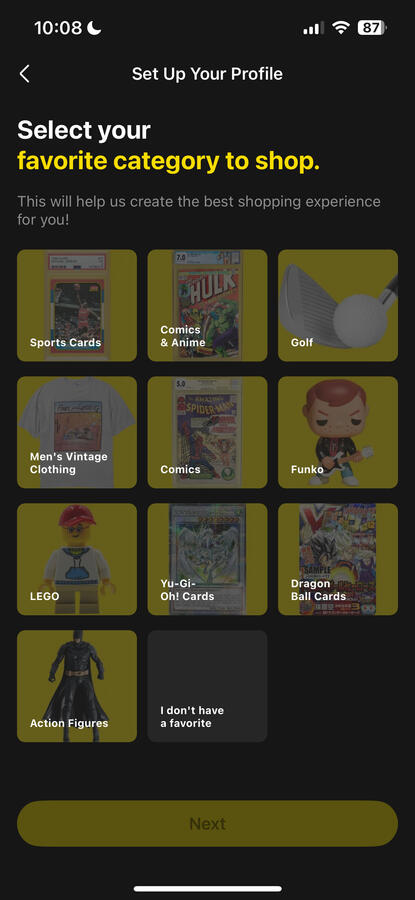

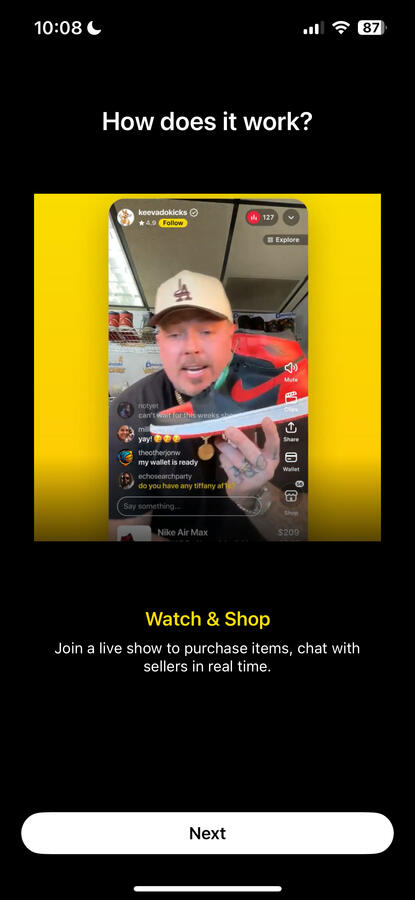

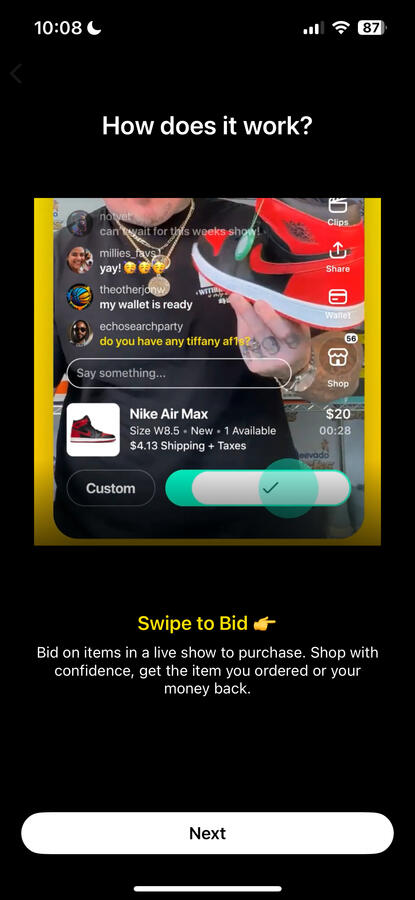

Whatnot Product (Buyer View)

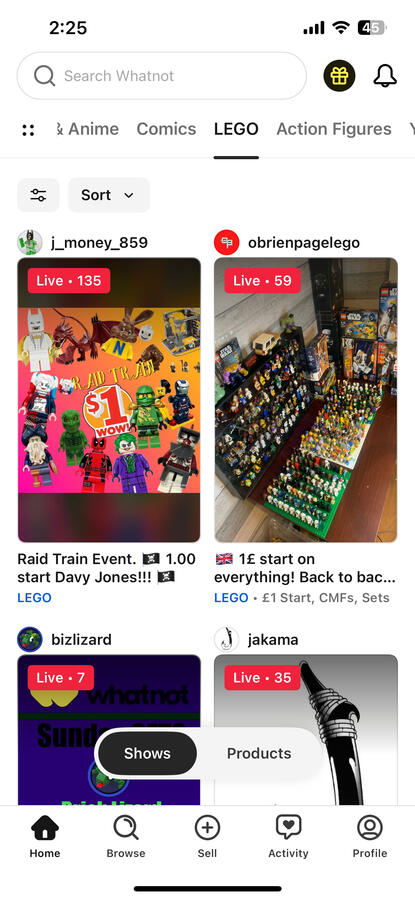

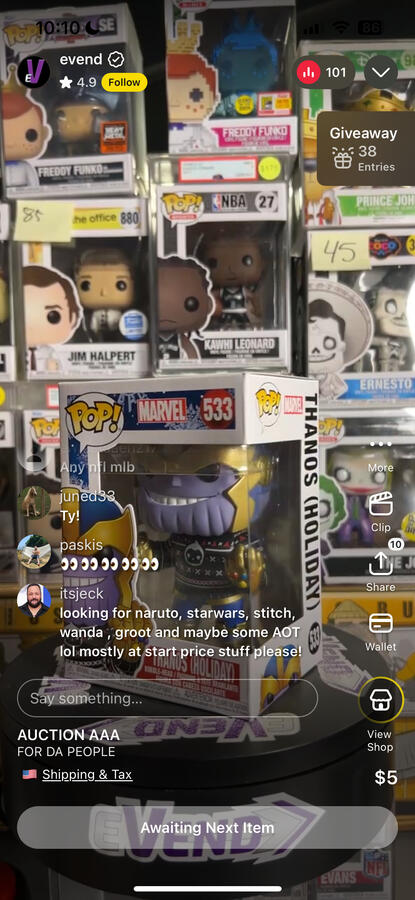

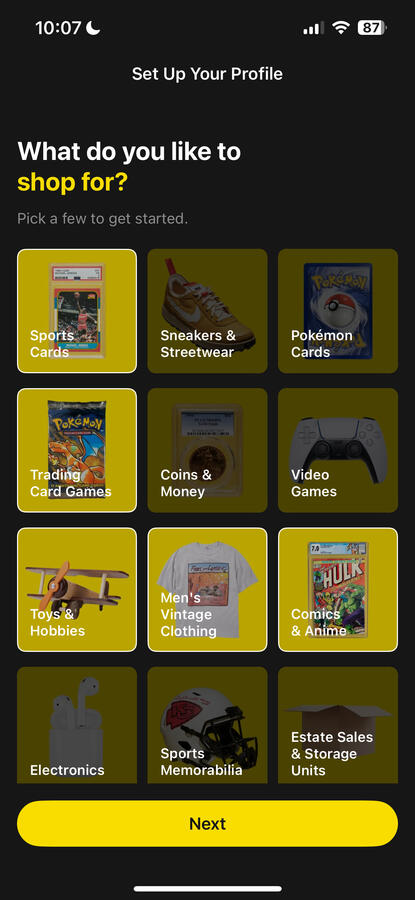

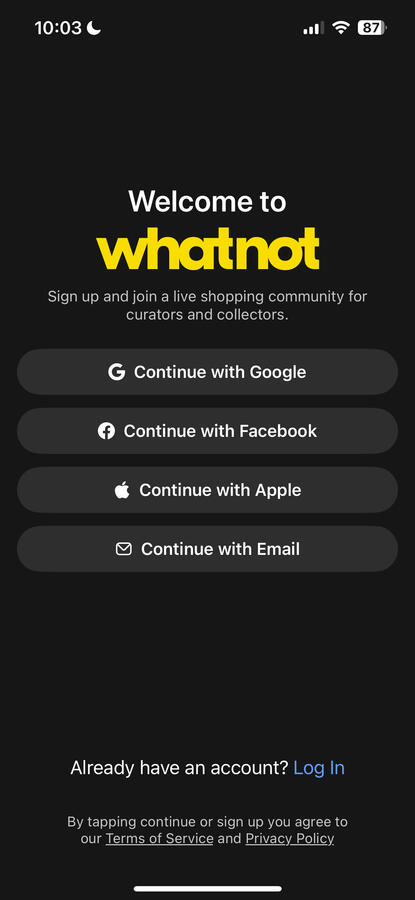

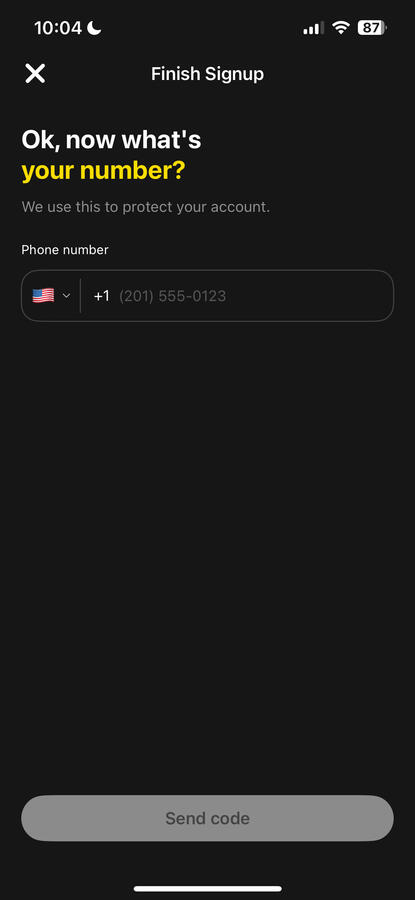

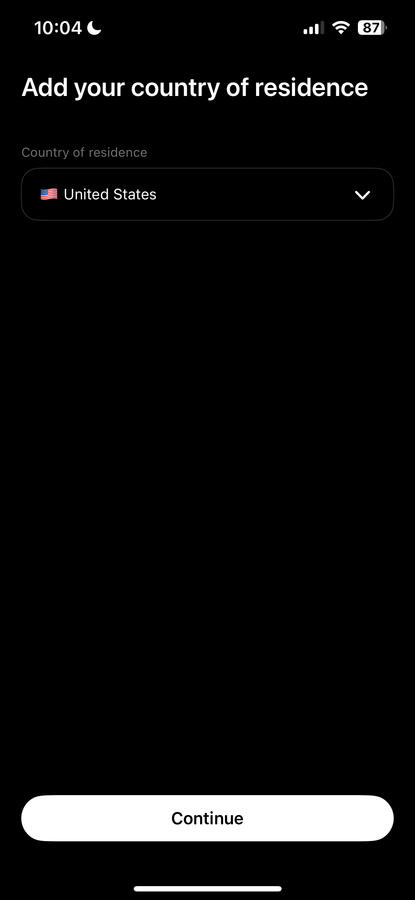

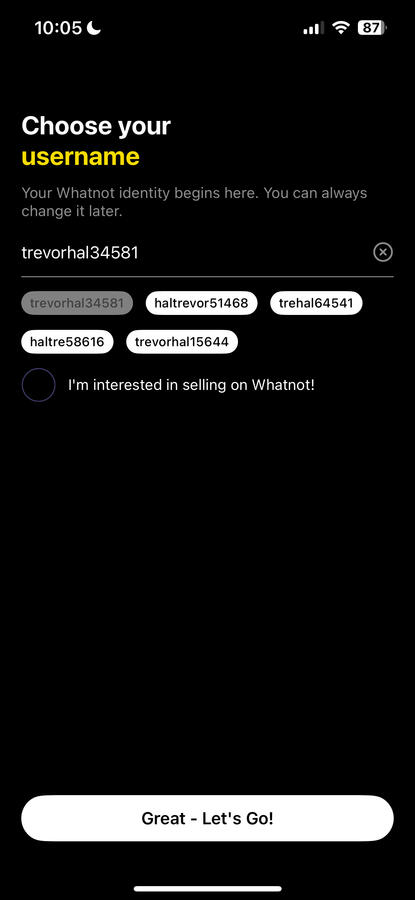

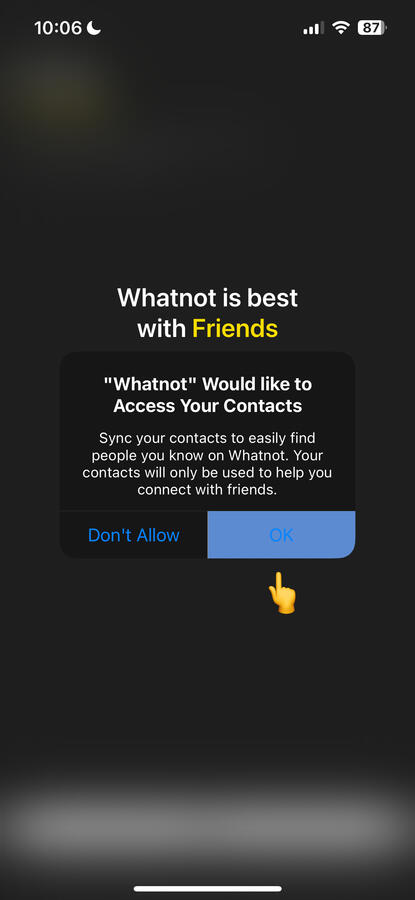

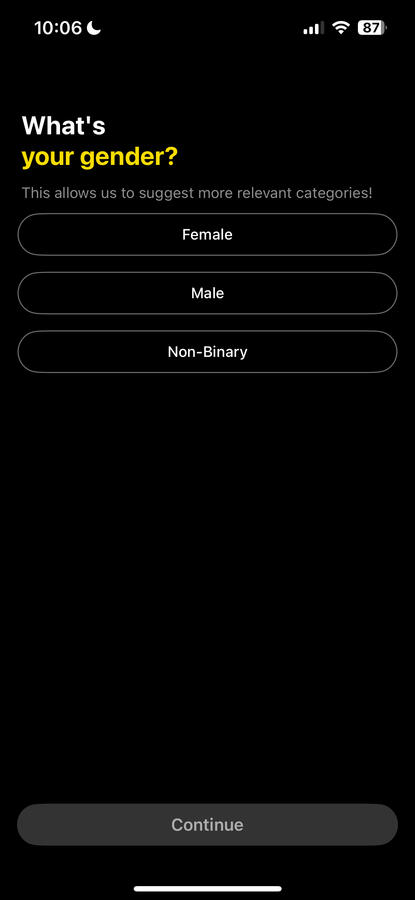

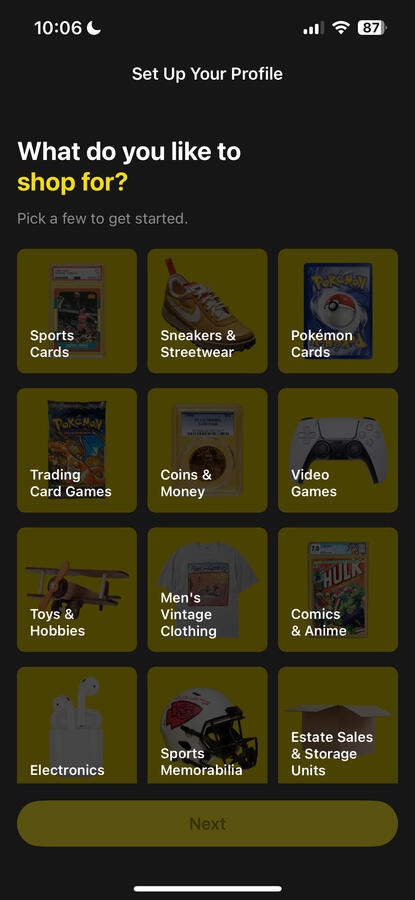

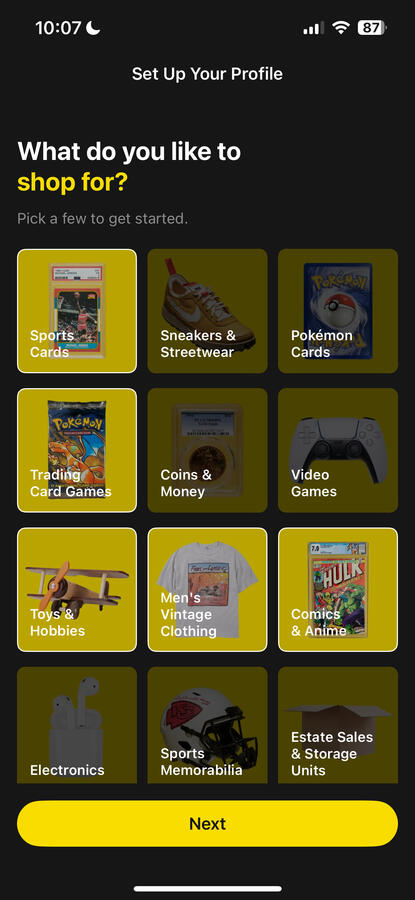

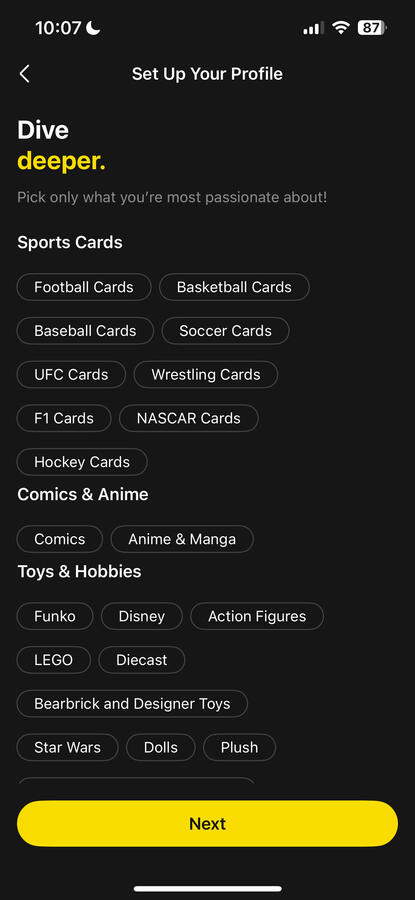

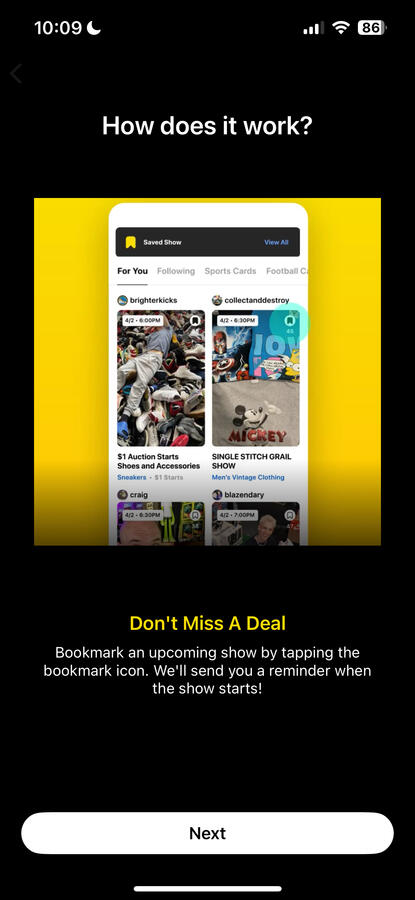

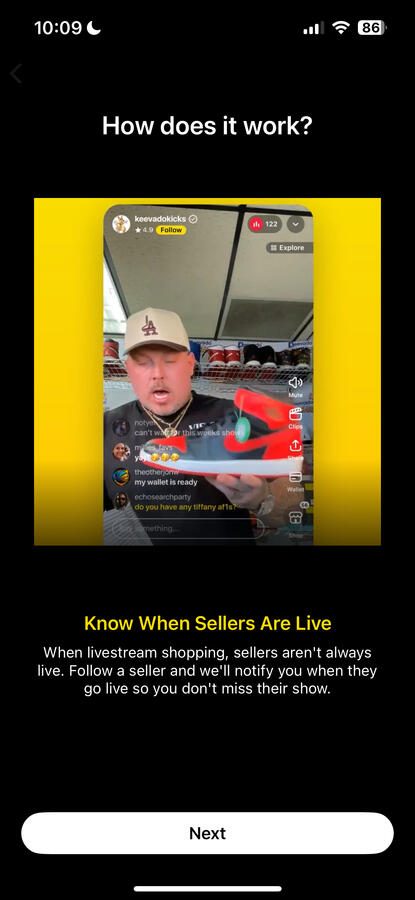

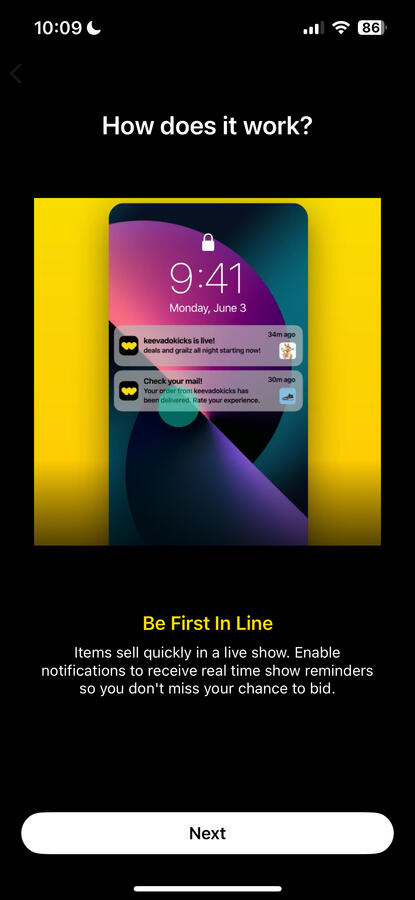

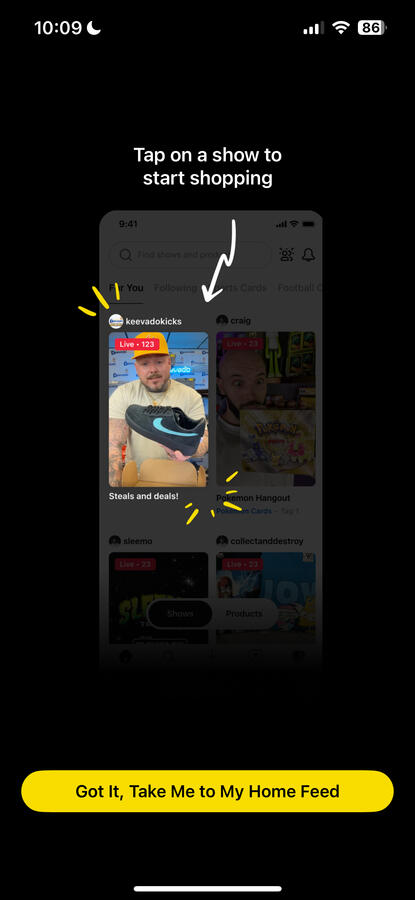

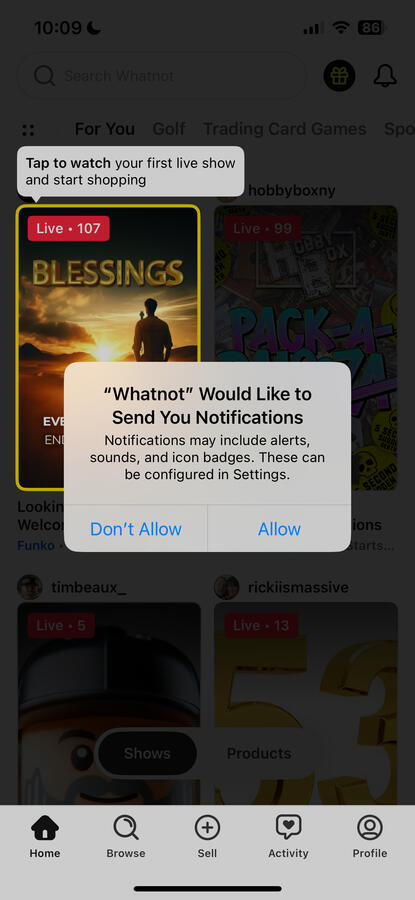

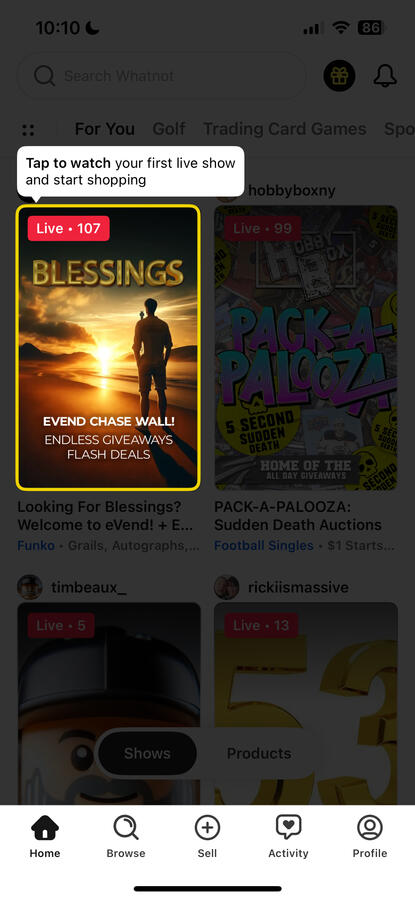

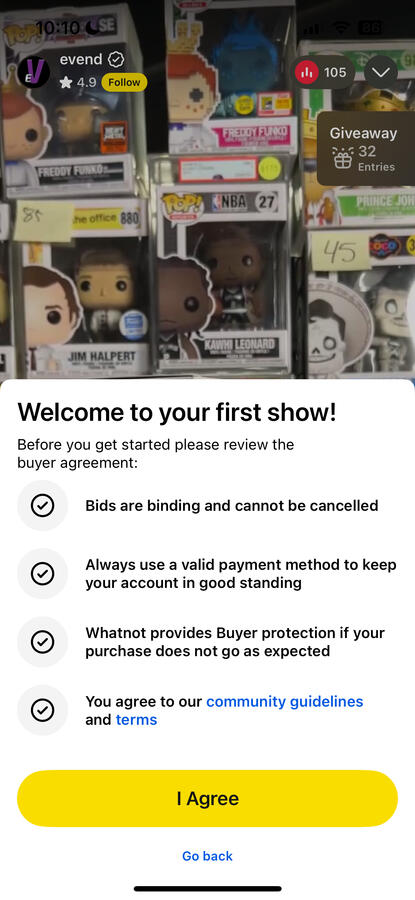

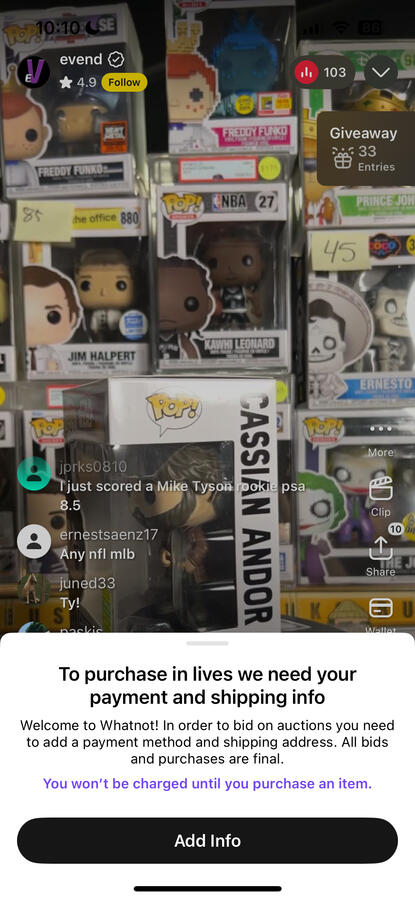

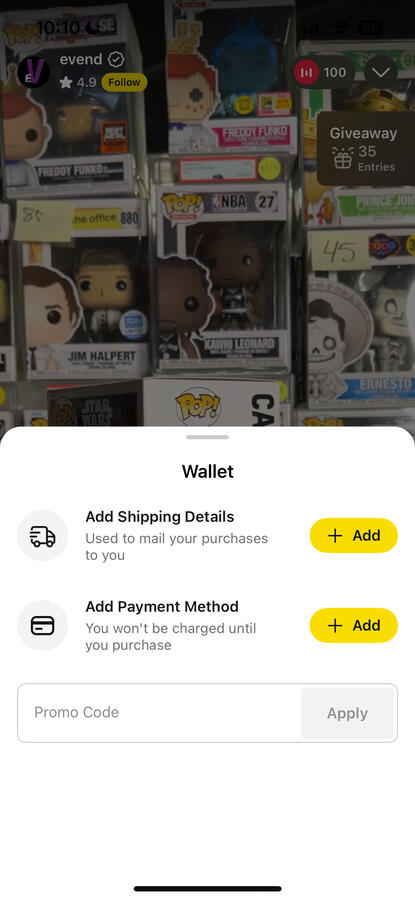

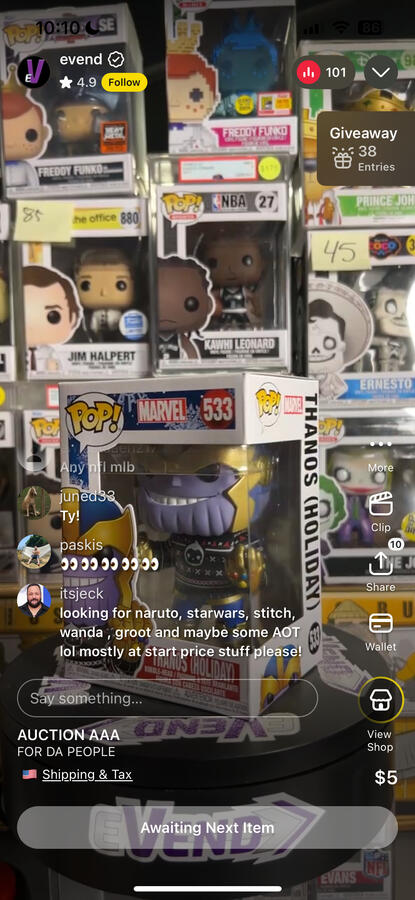

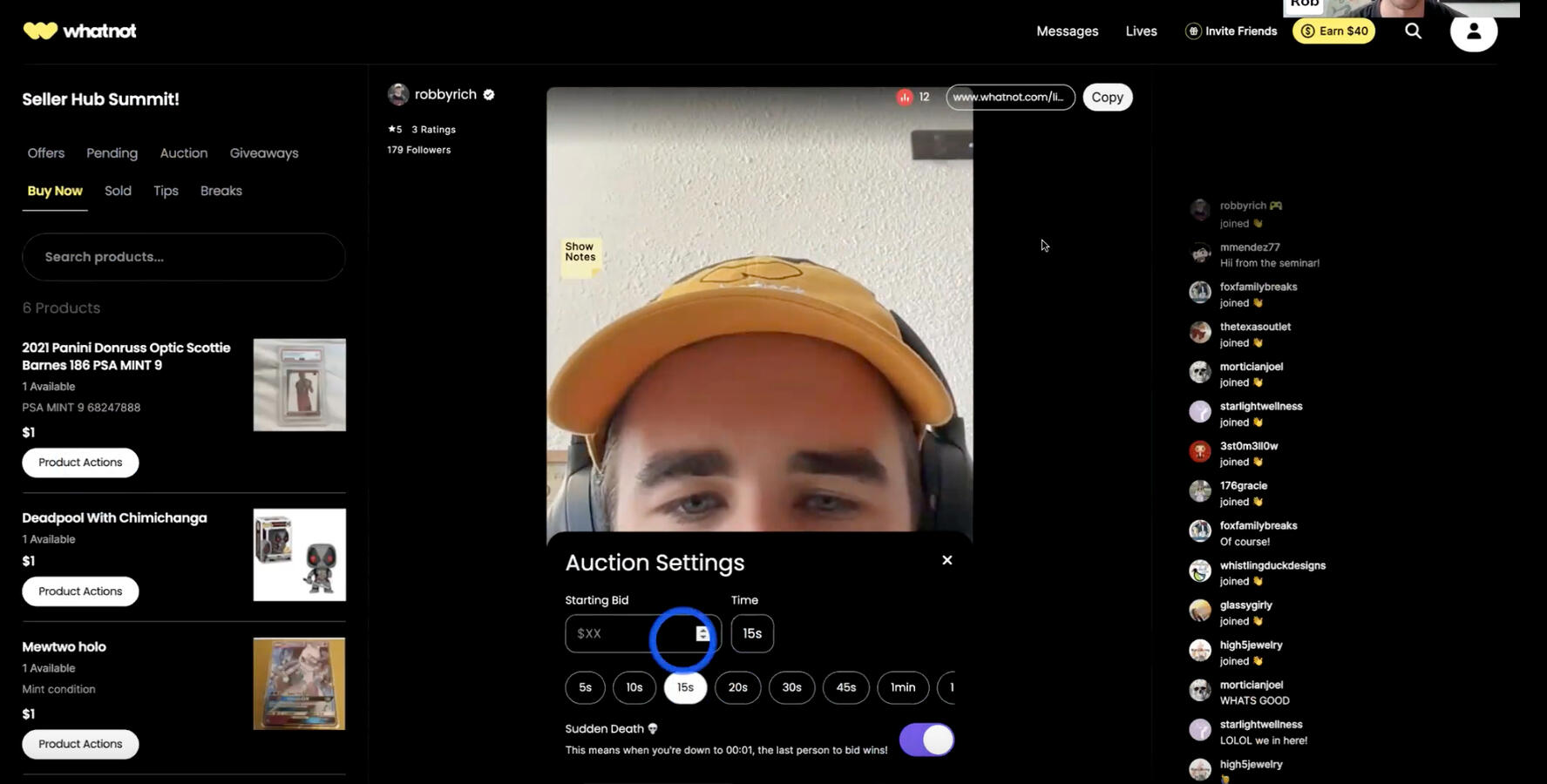

I don't generally believe in external critiques of a product. Those doing the work, running experiments and analyzing the data understand their product than any backseat Product person. During my time building a company, I generally rolled my eyes when I got unsolicited "have you ever thought of..." from interviewees (and more often than not VC's who's "brilliance" never ceased to amaze me). When you are working on a problem all day, every day; yes, you have generally thought of everything, it's a matter of data, user feedback, and prioritization. You are never short on ideas.I signed up for Whatnot today, primarily interested due to some of the job descriptions they had posted. I have never been exposed to live social selling enabled through a smartphone before, and needless to say, I was hooked!The onboarding (which I captured in screenshots in the next section) was somewhat lengthy, but with so many collectible categories out there, it is obviously key to get first time users connected with something of interest.The strangest part of the onboarding to me was selecting my favorite category to shop and getting dropped on a home-screen with a selection for what looked to be a religious mass. I clicked anyways and got a livestream of Funko Pops getting sold. I suppose I selected that category during onboarding, but it seemed strange to me to ask a primary shopping category then NOT show me that.I continued on and watched a bit of the show, getting prompted to input my address and payment info...something that seemed premature (I understand though, because these auctions can be QUICK. If you don't have your info in, you might miss out on an opportunity to buy something you're interested in.)I spent some time looking around the stream, and stumbled on the Giveaway. I, like everyone, love a good giveaway. To join, I had to add my shipping address and payments detail. From there, I started following the stream, continually joining giveaways and watching Funko after Funko make their way through live auctions. I'd love to know the Conversion Rate of getting a new user to enter their Delivery Address and Payment Info post onboarding. What experiments have been run to use Giveaways to attempt activate new users.I haven't made my first purchase yet (though I have been very close to!), but I'm looking forward to spending more time on the app, browsing new categories, watching more shows, and discovering the game mechanics these streamers use to drive engagement.

Whatnot Onboarding Teardown

I don't have much more to comment on the overall onboarding experience. If I were to make any unsolicited comments:

- I would add some "motion", some trends to the collectible categories. Help me discover new interesting categories that are receiving high activity via streams, followers and sales.

- "How does it work": there are 5 screens and you get kind of lost during that part of the onboarding especially when 3 of the screens have what looks like the same screenshot. A basic onboarding progress bar will do. Does this "move the needle"? No, probably not, it's very minor.

- I ultimately didn't mind the show recommendation once I got into it. But I'd want to experiment partnering with several shows and restrict the first time experience to those shows. Run giveaways in collaboration with the shows to increase the number of people adding their Shipping Details and Payment Method.

- I would be more intentional about promoting the Giveaway. Showcase it in Home/Browse and promote it for first time users when they reach their first show.Overall, the product is great! It's simple to learn, and easy to use. You can scroll videos in a familiar way to other social platforms (swipe up). I'll have to spend some more time on the Feed/Search/Discovery.NOTE: This is all from the buyers perspective, I haven't spent time on the Seller side, but it looks like they have recently released a suite of new features to enhance the Seller experience.

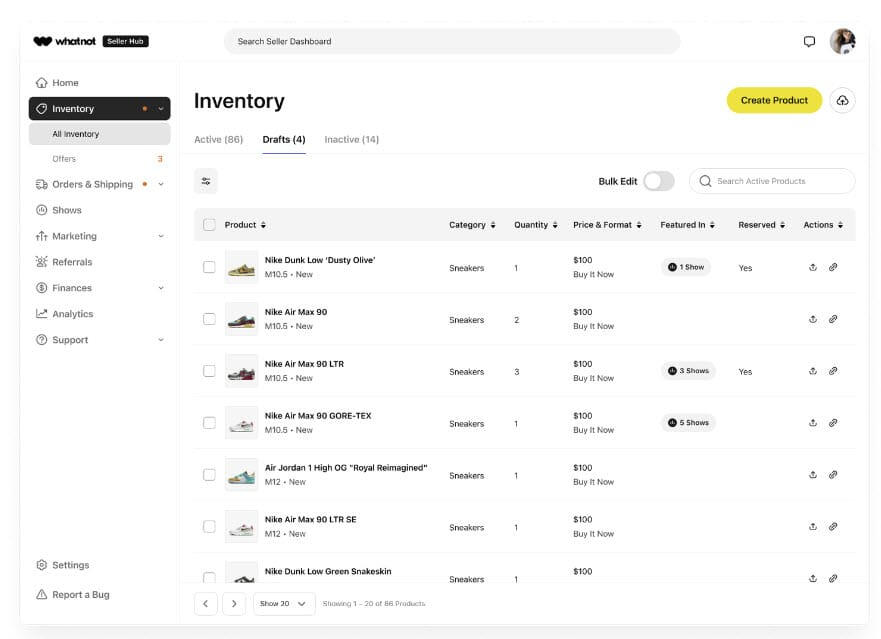

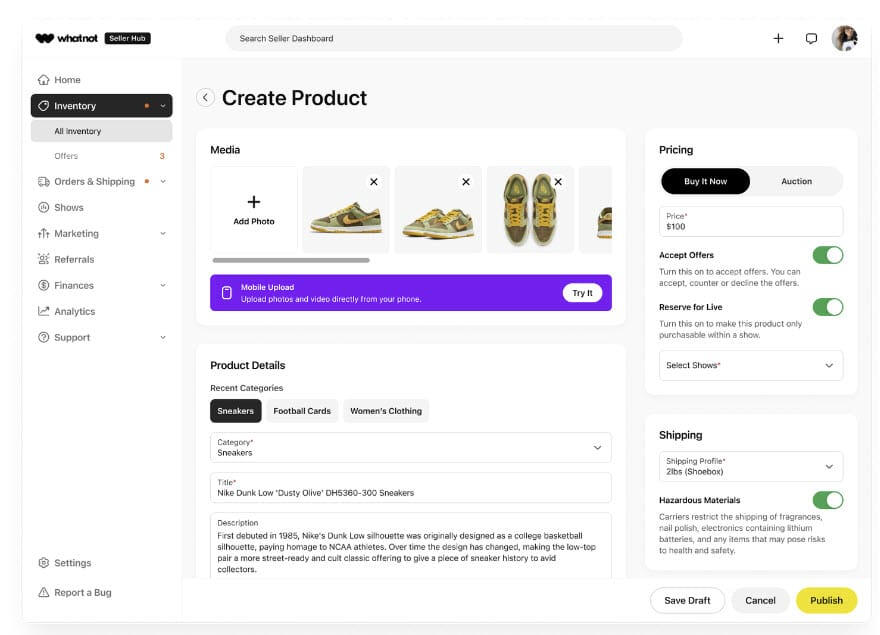

Whatnot Seller Experience

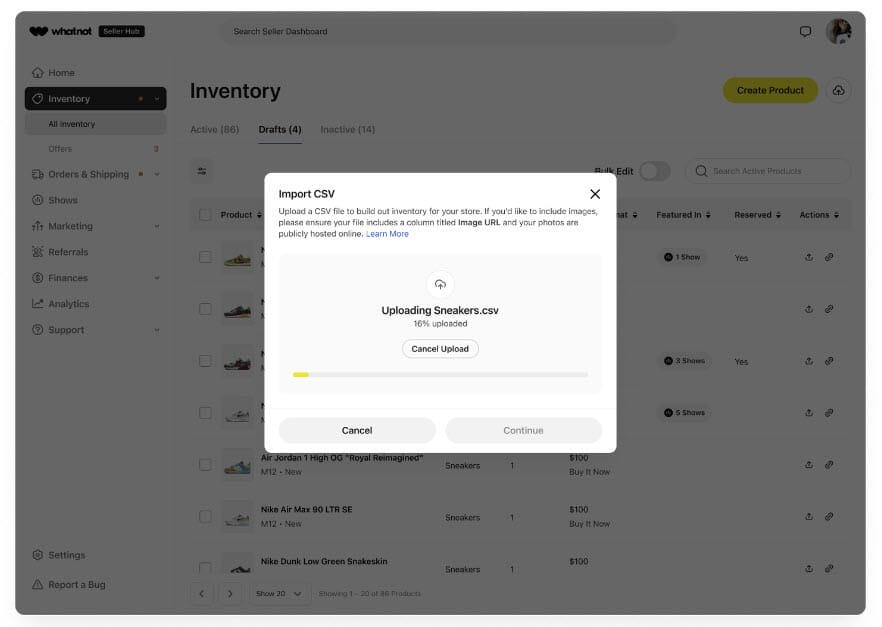

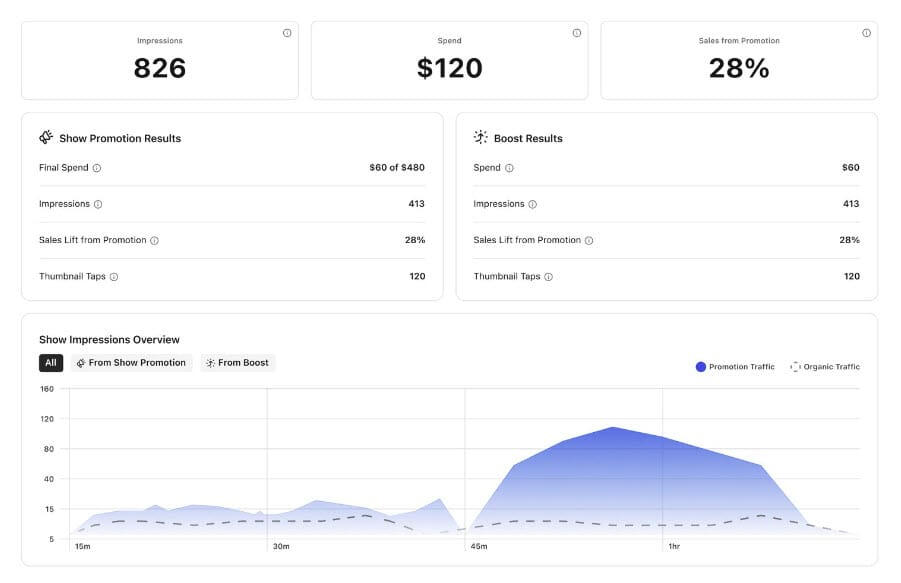

When dealing with selling a few items, it is not overly complex to handle it; but some of these sellers are processing hundreds of orders a day. This means inventory management and processing shipping is essential to get right. When you peak behind the seller experience, you can see the Whatnot team has put in a ton of work.

Summary of KPIs

As a Product person, I can't help but to start with KPIs to understand the product, what drives the experience and how you ensure your work aligns to the overall business strategy. For fun, I've thought up some high-level KPIs:

Buyer Segment KPIs:

Top of Funnel:

- New Buyer Sign-Ups

- Traffic GrowthMid-Funnel:

- Buyer Activation Rate

- Engagement Metrics

- Time to First PurchaseBottom of Funnel:

- Buyer Retention Rate

- Customer Lifetime Value (CLV)

- Churn Rate

Seller Segment KPIs:

Top of Funnel:

- New Seller Sign-Ups

- Traffic GrowthMid-Funnel:

- Seller Activation Rate

- Engagement Metrics

- Time to First RevenueBottom of Funnel:

- Seller Retention Rate

- Revenue per Seller

- Churn Rate

Combined KPIs:

Referral and Incentive Program

- Referral Program Participation

- Referral Conversion Rate

- Incentive Utilization Rate

- Affiliate Program PerformanceOverall Growth and Strategic KPIs

- Monthly Active Users (MAU) / Daily Active Users (DAU)

- Net Promoter Score (NPS)

- Revenue Growth

Key KPIs

Top of Funnel KPIs

| Buyer/Seller | Metric | Description | Importance |

|---|---|---|---|

| Buyer | New Buyer Sign-ups | The number of new buyers registering on the platform. | Measures the effectiveness of marketing and acquisition strategies. |

| Buyer | Traffic Growth | The increase in visitors to the platform from various channels. | Indicates the reach and visibility of Whatnot across different marketing channels. |

| Buyer/Seller | Metric | Description | Importance |

|---|---|---|---|

| Seller | New Seller Sign-ups | The number of new sellers registering on the platform. | Measures the effectiveness of seller acquisition strategies. |

| Seller | Traffic Growth | The increase in visitors to seller registration and onboarding pages. | Indicates the reach and visibility of Whatnot’s seller recruitment efforts. |

Mid Funnel KPIs

| Buyer/Seller | Metric | Description | Importance |

|---|---|---|---|

| Buyer | Buyer Activation Rate | The percentage of new buyers who make their first purchase within a specific period. | Measures how effectively new buyers are being converted into active buyers. |

| Buyer | Engagement Metrics | Metrics such as average session duration, number of sessions per buyer, and interaction rates with key features. | Evaluates how engaged buyers are with the platform. |

| Buyer | Time to First Purchase | The average time it takes for a new buyer to make their first purchase. | Indicates the efficiency of the onboarding and activation process. |

| Buyer/Seller | Metric | Description | Importance |

|---|---|---|---|

| Seller | Seller Activation Rate | The percentage of new sellers who list their first item or conduct their first live auction within a specific period. | Measures how effectively new sellers are being activated. |

| Seller | Engagement Metrics | Metrics such as average session duration, number of sessions per seller, and interaction rates with seller tools and features. | Evaluates how engaged sellers are with the platform. |

| Seller | Time to First Revenue | The average time it takes for a new seller to generate their first revenue. | Indicates the efficiency of the seller onboarding and activation process. |

Bottom of Funnel KPIs

| Buyer/Seller | Metric | Description | Importance |

|---|---|---|---|

| Buyer | Buyer Retention Rate | The percentage of buyers who return to make additional purchases over time. | Measures the platform’s ability to retain buyers. |

| Buyer | Customer Lifetime Value | The total revenue expected from a buyer over their entire relationship with the platform. | Helps in understanding the long-term value and profitability of buyers. |

| Buyer | Churn Rate | The percentage of buyers who stop using the platform over a specific period. | Indicates potential issues in buyer satisfaction and areas for improvement. |

| Buyer/Seller | Metric | Description | Importance |

|---|---|---|---|

| Seller | Seller Retention Rate | The percentage of sellers who continue to list items or conduct auctions over time. | Measures the platform’s ability to retain sellers. |

| Seller | Revenue per Seller | The total revenue generated by a seller over a specific period. | Helps in understanding the productivity and profitability of sellers. |

| Seller | Churn Rate | The percentage of sellers who stop using the platform over a specific period. | Indicates potential issues in seller satisfaction and areas for improvement. |

Combined KPIs - Referral and Incentive Program

| Metric | Description | Importance |

|---|---|---|

| Referral Program Participation | The number of users participating in referral programs and the number of new users brought in through referrals. | Assesses the success of referral incentives and their impact on user growth. |

| Referral Conversion Rate | The percentage of referred users who sign up and become active users. | Measures the effectiveness of the referral program in acquiring quality users. |

| Incentive Utilization Rate | The percentage of users who redeem incentives or rewards offered through the platform. | Evaluates the attractiveness and effectiveness of incentive programs in driving user actions. |

| Affiliate Program Performance | Metrics such as the number of affiliates, affiliate-driven traffic, and conversions from affiliate channels. | Assesses the impact of the affiliate program on user acquisition and revenue growth. |

Combined KPIs - Overall Growth and Strategic

| Metric | Description | Importance |

|---|---|---|

| Monthly Active Users (MAU) / Daily Active Users (DAU) | The number of unique users who engage with the platform within a month/day. | Provides a snapshot of the platform’s active user base and overall growth. |

| Net Promoter Score (NPS) | A measure of user satisfaction and likelihood to recommend the platform to others. | Indicates overall user sentiment and the success of community-building efforts. |

| Revenue Growth | The increase in total revenue generated by the platform over time. | Reflects the financial health and growth trajectory of the platform. |

Sales Model

Watching several hours of streamers selling Funko pops got me interested on how much these people might be making and how much Whatnot could be making. Let's start with some assumptions about the model:

% of Sales (Live Auction vs Traditional Auction): 70-90% of sales coming from live auction

Average number of auctions per minute: Between 1 and 3

Average price per auctioned item: $30 to $50

Whatnot take rate: 8%

Average stream runtime: 1 to 3 hours

Let's use the following variables to analyze sales and net revenue for the streamer and Whatnot.

- Auctions per Minute: 2

- Average Price per Auction: $40

- Whatnot Take Rate: 8%

| Time Streamed (mins) | Number of Sales | Total Sales ($) | Net Revenue ($) | Whatnot Revenue ($) |

|---|---|---|---|---|

| 60 | 120 | 4800 | 4416 | 384 |

| 120 | 240 | 9600 | 8832 | 768 |

| 180 | 360 | 14400 | 13248 | 1152 |

| 240 | 480 | 19200 | 17664 | 1536 |

| 300 | 600 | 24000 | 22080 | 1920 |

Table: An Analysis of Sales based on Time Streamed

Customer Purchases to Determine Customer Acquisition Cost

Let's start by defining some buyer personas based on number of items purchased:

- Non-Buyers (0 Purchases): 90% of Users

- Average Buyers (2 Purchases): 8% of Users

- High Propensity Buyers (10 Purchases): 1.9% of Users

- Major Collectors (50 Purchases): 0.1% of Users

| Buyer Persona | % of Users | # of Purchases per User | Avg Price per Item | Total Buyer Spend | Whatnot Revenue per User |

|---|---|---|---|---|---|

| Non-Buyer | 90% | 0 | $0.00 | $0.00 | $0.00 |

| Average Buyer | 8% | 2 | $40.00 | $80.00 | $6.40 |

| High Propensity Buyer | 1.9% | 10 | $80.00 | $800.00 | $64.00 |

| Major Collector | 0.1% | 50 | $120.00 | $6000.00 | $480.00 |

If we can use the above assumptions and model it per 1000 users, we assume we generate a total revenue of $27,600. That gives us an average Whatnot revenue per user of $2.208, meaning there are very thin margins to spend on Customer Acquisition Cost.

So much I don't know...

I'd be curious to learn more how these assumptions align with real data from Whatnot. And of course, the more time I spend with the product, the more I'd love to work on the product. To help connect people with their inner child and bring collectibles to more people would be a ton of fun.

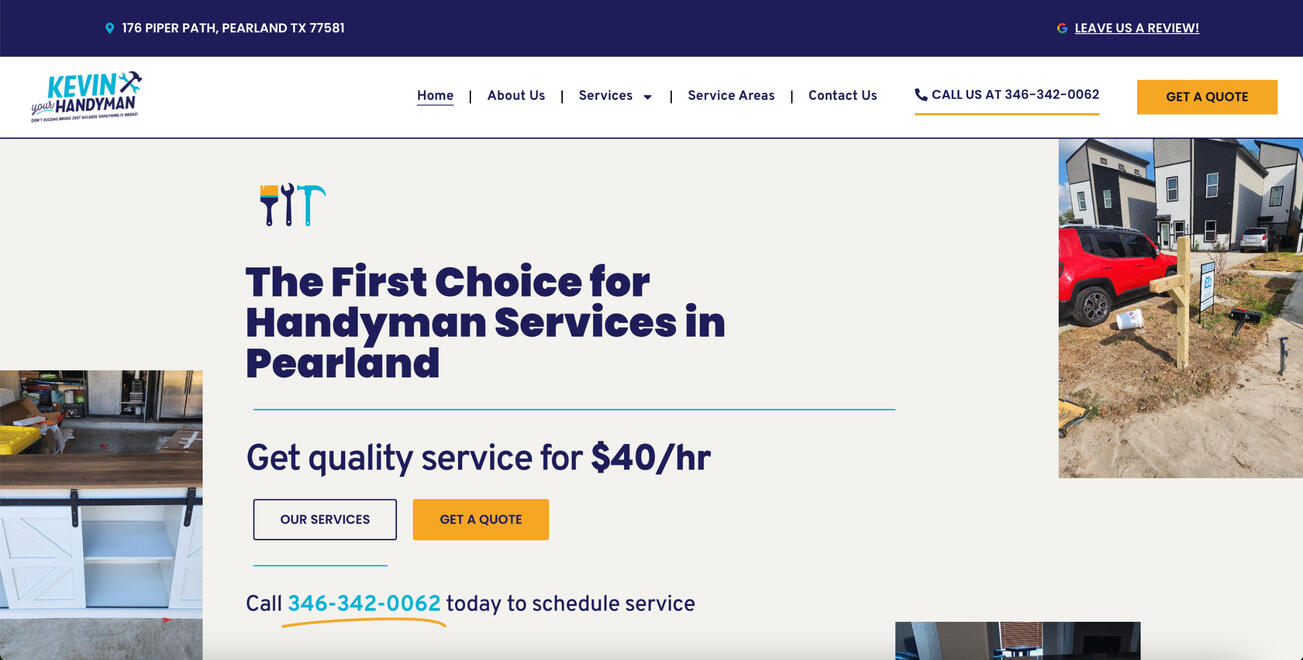

FieldBin - Field Service Management Software

FieldBin is a field service management software helping small field service companies build their business through improving their operations. These business owners...

FieldBin Agency - Home Service Marketing Services

I ideated, wrote and designed a home service marketing service to help enable software customers grow their business by winning on Google. This enabled FieldBin to increase their monetization of each software customer (and vice versa). Upon launch, the team was able to land 5 new clients in under 30 days, adding an additional revenue stream to continue leveling up their service offering.I have also been in charge with the web design and SEO optimization of webpages, managing all aspects of the home service business owners go-to-market.

https://www.fieldbin.com/field-services-marketing-agency/